Disclosure: I received this complimentary product through the Homeschool Review Crew.

We see so many people in debt today. Multiple credit cards they can’t pay off, loans they are trying to make payments on, and they can’t stop the cycle. However, as parents, we can help our children avoid this by teaching them financial literacy. Our family has been using the PersonalFinanceLab Budgeting Game, Stock Market Game, and integrated curriculum through the Homeschool Review Crew. PersonalFinanceLab.com offers a great way to teach your kids the financial skills they need for the future.

Table of Contents

- Financial Literacy with PersonalFinanceLab.com

- How We Used PersonalFinanceLab in Our Homeschool

- Does This Program Teach Financial Literacy

Financial Literacy with PersonalFinanceLab.com

What is PersonalFinanceLab.com?

PersonalFinanceLab.com is an online program with a budget and stock market game. Both have integrated curriculum, too. The online lessons help kids learn about the stock market and concepts related to financial literacy (like credit score, interest, and more).

The programs are geared towards high school students, though upper middle school kids could probably use it, too. Mine did.

Overall, they seek to help students become financially literate and teach them, in a safe environment, the financial decisions they will need to make in the future. They do this through a very engaging game format. Kids will really enjoy exploring and learning.

How We Used PersonalFinanceLab in Our Homeschool

I have a 12 year old (6th grader) and a 14-year-old (8th grader) in our homeschool. I planned on using the Budget and Stock Market games with my daughter, maybe my son, once I checked it out. So, I set up an account for my 8th-grade daughter and one for me.

Well, once we got started, I realized my 6th grader could probably give the budget game a try. He ended up using my account.

It can be a little overwhelming at first. Luckily the site has video tutorials that explain how to set things up AND how to use each game. I was still a bit confused about how the games worked, but I found just jumping in, and playing was the easiest way for us to figure it out (once we had a general idea of the steps from the video).

The Budget Game- Financial Literacy Begins

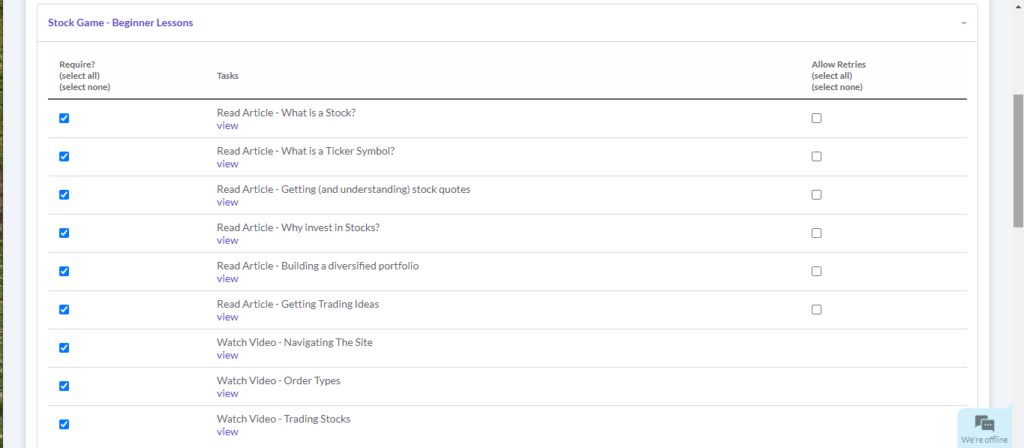

We started with the Budget Game. I set up a few lessons for my daughter to watch along with playing the game. She was sooo nervous when she began, but quickly realized it was easy to use. Her concern was making a “mistake” in the game, i.e., a wrong choice.

How to Play the Budget Game

First of all, you can set up the budget game, so your child is a college student for the whole game or partway through they graduate and get a full-time job. For our first time, I set it up so we would be students for the entire game.

So what does that mean?

Well, it means that you have a part-time job while taking classes. You also have roommates to help pay expenses like rent. It isn’t a full adult experience. You are, after all, still a student and make decisions around student issues you might face.

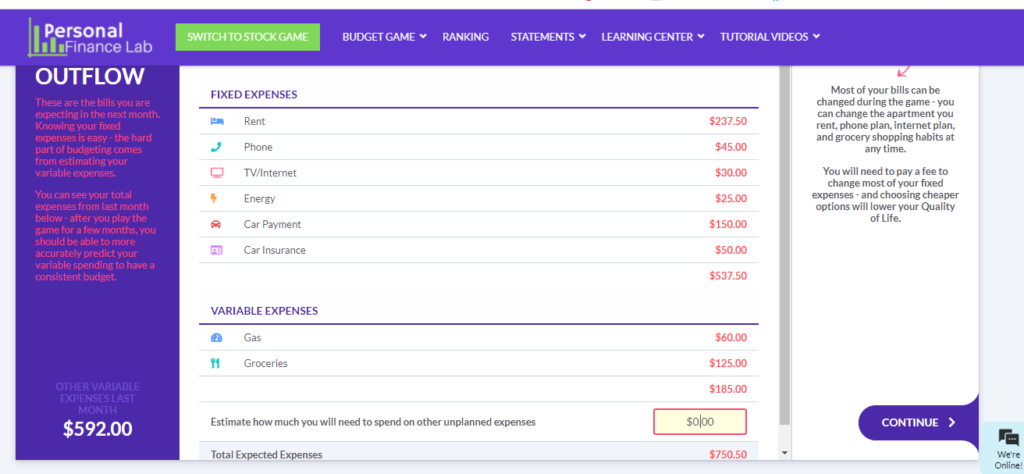

Next, students need to make decisions that will affect their monthly budget. They need to decide:

- how many roommates they will have, which impacts rent costs

- choose cell/internet plans

- savings goals (they recommend 10% of your gross wages)

- food budget

Kids are not stuck trying to figure things out on their own. Nooo.

For some choices, there is a lesson that teaches them more to make an informed decision. Other times, they provide information to help see the consequences (positive or negative) for a particular choice. I love that it does this.

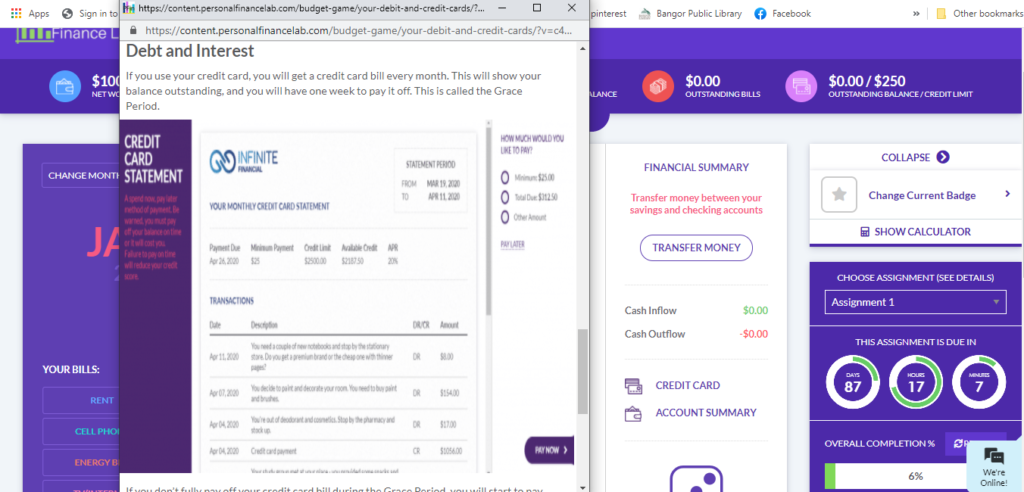

Another cool feature is that kids need to decide whether to pay bills and expenses with a debit or credit card. Kids learn about using a credit card and the role it plays in your credit score. There is a whole lesson on compound interest and what happens when you don’t pay off your credit card each month. The credit card lessons are so crucial!

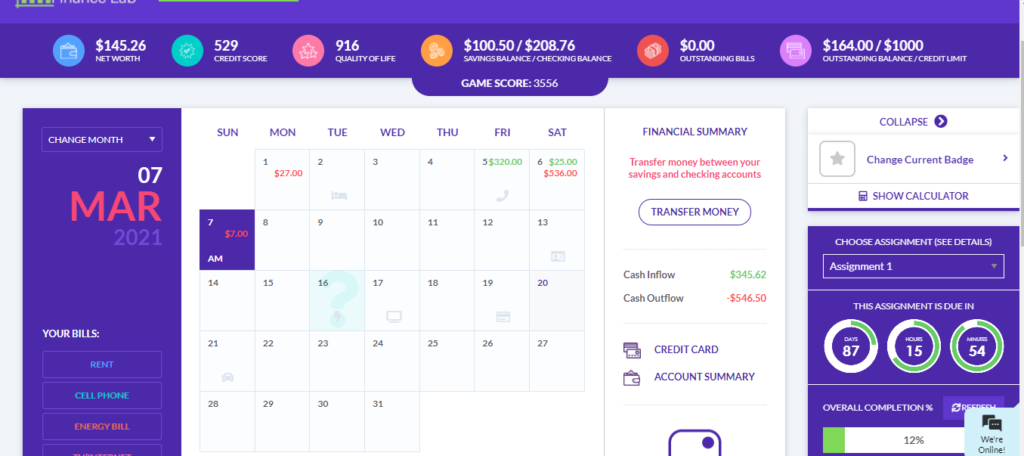

Kids pay their bills throughout the month (rent, car insurance, TV/Internet, cell phone, energy bill, credit card). They must keep track of when bills are due and pay them on time. They receive a statement showing what they owe and need to decide how to pay for it- credit or debit.

Unexpected expenses come up. Things break in your apartment, you use more gas than planned, you throw a party for your friends, or your car needs a major repair. Kids need to decide how to handle these problems as they arise. At one point, my daughter injured her leg and needed to decide whether to get it checked out (pay money) or wait and see.

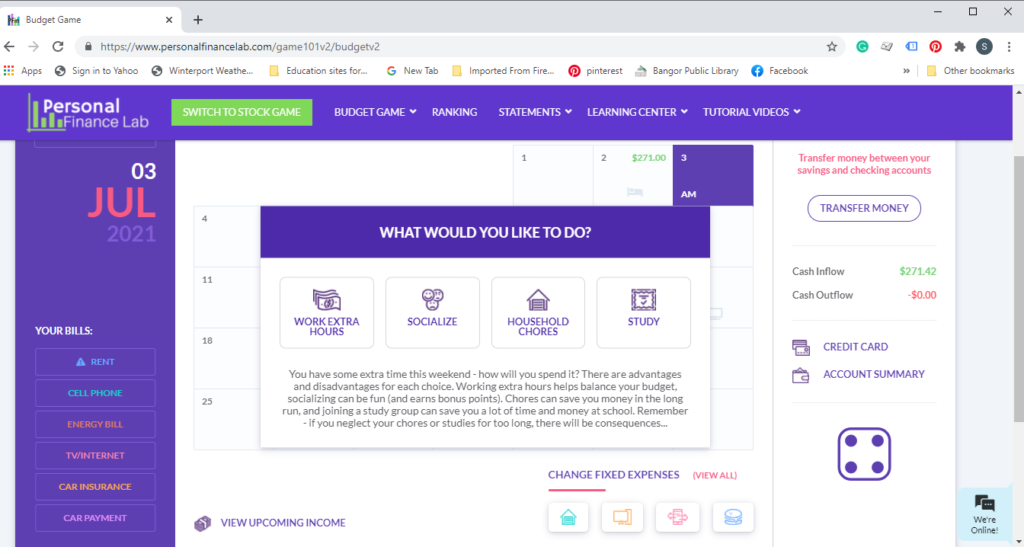

The whole game is about balancing your life- do you work more hours, study, do home repairs, or socialize.

My daughter figured out a pretty good balance. Some weekends she worked extra if she had a lot of expenses that came up during the week. Other weekends, she would do home repairs, study, or socialize. Overall, she did well. Her quality of life and credit scores increased.

I decided to let my son, my 6th-grader, give it a try. He struggled. However, it wasn’t because the game was too hard. The first few months of the game, he had to pay a lot of out-of-pocket expenses. EVERYTHING seemed to go wrong. Sounds like life, huh? He was getting discouraged. He was unable to save money, and his bank account was dwindling. It was a great life lesson.

Eventually, the game started turning around, and he was able to start saving money and improve his quality of life and credit score.

The Stock Market Game

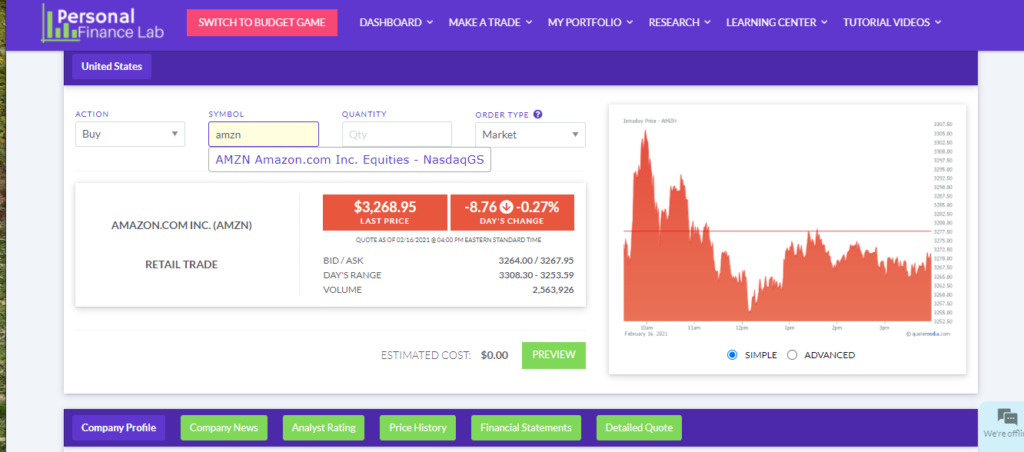

The Stock game is the real-world stock market. All the information is real, but you are playing with imaginary money. The trends of the stocks in the game are how they are doing in the real-world market. You can view current news articles and trends that affect the stock market to help make decisions in the game.

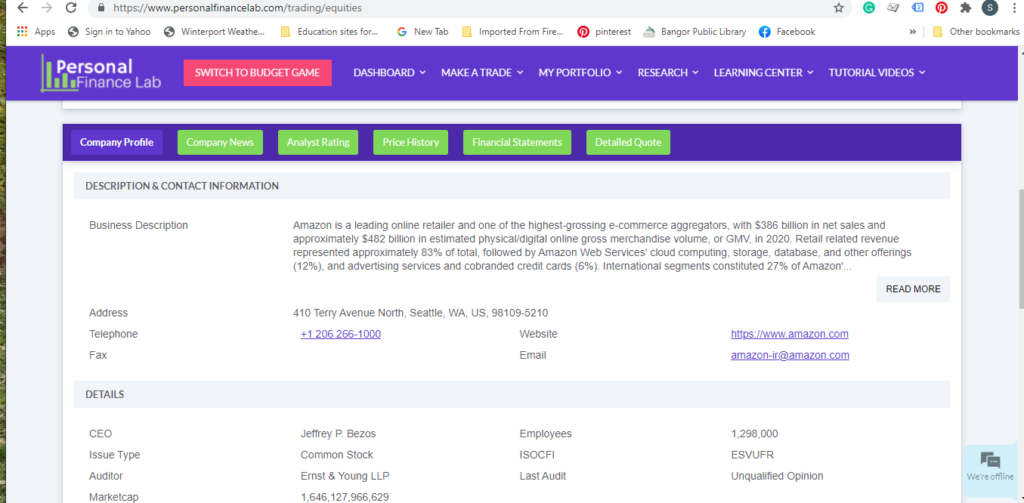

Info on a stock looking to buy.

More in-depth info on a stock.

I will admit, we were hesitant to get started with the Stock Game. For this game, I set up a lot more lessons to view. We don’t have a lot of experience with the stock market or a good understanding of it. I’ll admit, I pay a financial advisor to deal with it.

Eventually, we got started with the game. And you know what? It wasn’t nearly as scary as I thought.

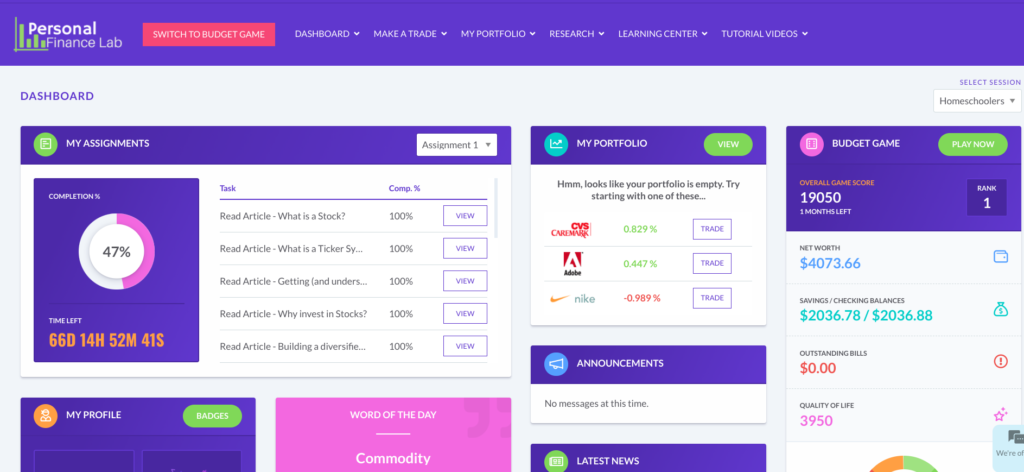

To start with, you have $100,000 to use to buy stocks. We watched lessons and learned how to trade stocks and critical concepts in the stock market. Then we jumped right in.

My 8th-grader has stocks in Apple, Walmart, Tesla, and Citigroup. She has made some money on her stocks, though she has seen how it fluctuates from day-to-day. Each day she checks her portfolio, looks at the trends for specific stocks, and decides whether to buy any new ones.

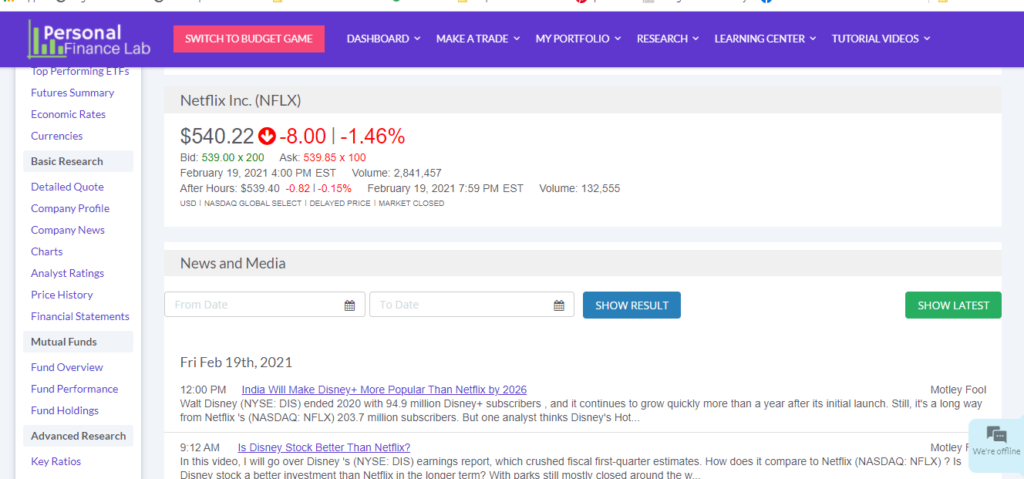

I began using the Stock game, too. My stocks are not doing as well as my daughter’s. I bought stock in Netflix, and it keeps dropping. I read some news articles (real-life news articles) provided in the game and realized the projection was Disney+ would become more prominent than Netflix in the years to come. With this new information, I decided to sell.

We will continue to work through the lessons to learn more about how the stock market works. I’ve realized I need a better understanding and not just rely on someone else (my financial advisor) to make those decisions. I need some knowledge and so do my kids.

Does This Program Teach Financial Literacy

I can’t express how impressed I was with PersonalFinanceLab.com. I would definitely recommend this for all high schoolers. It is a little confusing at first, but once you learn how to set everything up, it is a great program.

What I Love About the Budget Game:

- The Budget Games teaches kids the financial literacy skills they will need for the future. Kids learn about the “real” expenses and life decisions they will need to make. It is all done in a game format, so it is appealing to kids.

- The game teaches kids to balance their life. Sometimes you throw a party for your friends as long as you balance it with other things in your life.

- The lessons are short and very good at teaching critical financial skills like credit card interest, the different types of insurance people buy and why, etc. Students will even get paid when they answer the quiz question correctly.

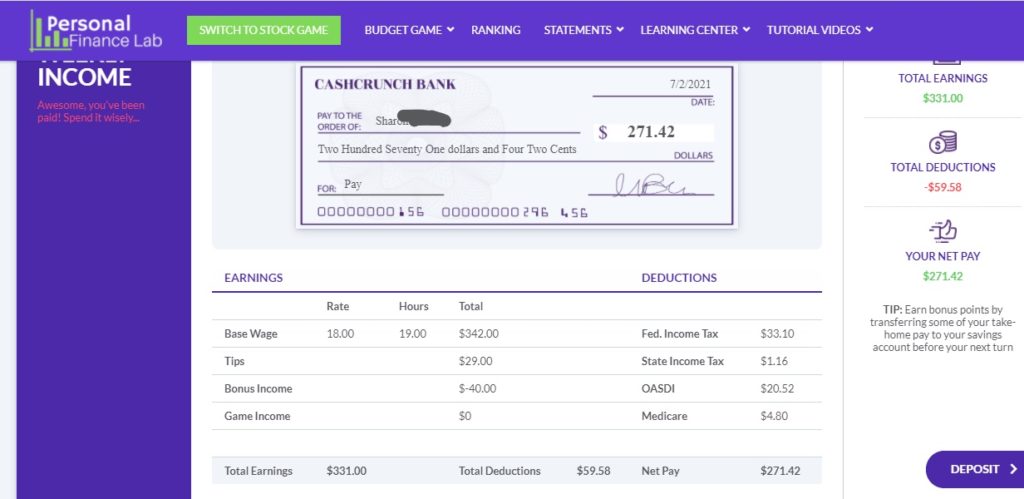

- Kids see different statements they will have in life. They view their paycheck and see what they earned and the deductions just like a real paycheck. At any time, they can look at their credit card statement and statements for their checking and savings account. I love that kids learn to keep track of where they spend money, how much they are saving, and how much money they earn.

Sample Paycheck

Life choices to make for the weekend.

Fixed and Variable Expense sheet so they can learn to budget.

What I Love About the Stock Game:

- I love that it is the real-world stock market. It is real-life learning at its best.

- The lessons, articles, and information in the game provide a good education on the stock market. You learn what the terms mean, how it all works, and see how life events impact the stock market.

Oh, another great aspect of the program is that the dashboard shows your stock portfolio, assignments information, and standing in the Budget Game all in one place. Take a look below. It is my daughter’s Dashboard.

Overall, I would recommend PersonalFinanceLab.com for educating kids on financial literacy. The curriculum and games provide a well-rounded education in a way that will stick with kids.

There is so much more to this program and the games. I couldn’t begin to describe it all. Check it out for yourself and all the other reviews by the Homeschool Review Crew.

good review, like how your personally phrased things.

Thank you!